Here’s What 100 Fintech & Insurtech Startups Teaches Us About 2025

I see hundreds of fintech and insurtech startups each year through our various events, funds and programs. And as genert8tor’s Fintech Practice Chair, I’m most focused on tracking trends and sharing those relevant insights with our fintech portfolio and our broader team. Usually, I review the latest reports from our friends at Carta or Pitchbook, but this time I decided to take some inspiration from our co-founders (Joe and Troy) and spend some time sifting through our internal data.

I pulled our latest Fintech and Insurtech Lightning Rounds, an initiative that connects our most promising startups and with investors and corporate partners in our network, to analyze the data behind the 95 startups that participated in this process.

Lightning Rounds are curated, one-on-one pitch sessions that connect selected early-stage startups with investors in our network. The model functions like a marketplace: investors opt in, review a pool of participating companies, and choose the startups most aligned with their thesis. gener8tor then facilitates those meetings, creating a streamlined, double-opt-in process that ensures every interaction is intentional. This “free-hand” market dynamic gives us valuable real-time signal on investor interest and broader trendlines across the ecosystem.

I hope this provides a look at where the market might be heading for our founders, investors and corporate partners as we head into 2026.

Let me know what you think!

1. What are our founders building?

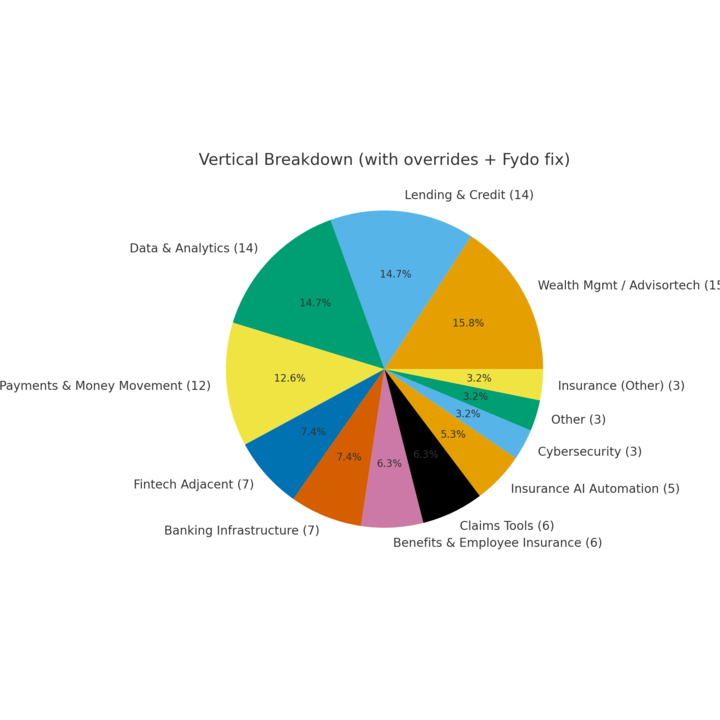

When we categorized all 95 startups, four major fintech verticals rose to the top:

Lending & Credit (Breva and Sandbox Wealth)

Data & Analytics (FinGoal and Oceanviews)

Wealth Management / Advisortech (Chantico Technology and Scout)

Insurance-focused companies were represented across the following verticals:

Benefits & employee insurance (Oro & SupportPay)

Insurance AI automation (GigEasy)

Claims tools (Counter)

Cybersecurity (Magier AI)

Takeaway #1: We drew the strongest concentration in Wealth Management / Advisortech, Lending & Credit, and Data & Analytics which collectively accounted for nearly half of the startups in our pool. The data also highlights a very balanced pipeline across the financial services industry.

2. What investors are actually selecting

If you build it, [they] will come.

If the applications tell us what founders hope investors want, the selections tell us what investors actually care about.

When we compare verticals by selection rate, here are the 5 hottest categories:

Wealth / Advisortech: 100% selected for 1:1 investor meetings

Claims Tech: 100% selected selected for 1:1 investor meetings

Insurance AI Automation: 100% selected selected for 1:1 investor meetings

Benefits / Employee Insurance: ~86% selected selected for 1:1 investor meetings

Lending / Credit: ~82% selected selected for 1:1 investor meetings

Takeaway #2: Vertical by vertical, the market leaned the heaviest into Wealth / Advisortech, Claims Tech, and Insurance AI Automation. Benefits / Employee Insurance along with Lending / Credit weren’t far behind.

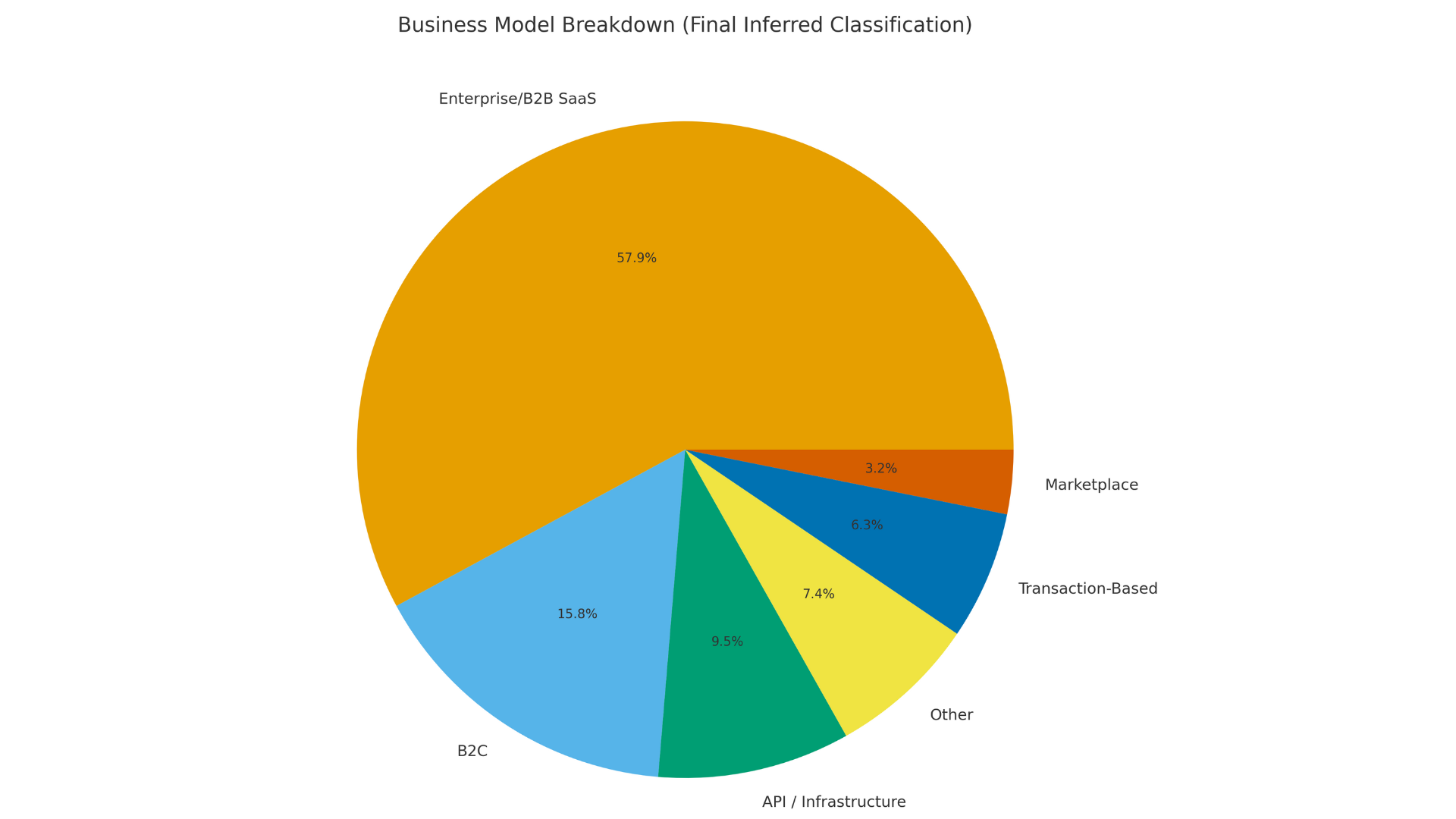

3. Business models: Enterprise SaaS is still king

Enterprise/B2B SaaS companies made up the largest portion of the pipeline, followed by transaction-driven businesses and a very small number of B2C startups.

Takeaway #3: As our portfolios have shifted more and more B2B in recent years, here’s the interesting part…Every B2C startup in our pipeline was selected. It’s not necessarily because consumer fintech is the new North Star. It’s because the few B2C startups that applied had strong traction and a clear roadmap to B2B or B2B2C.

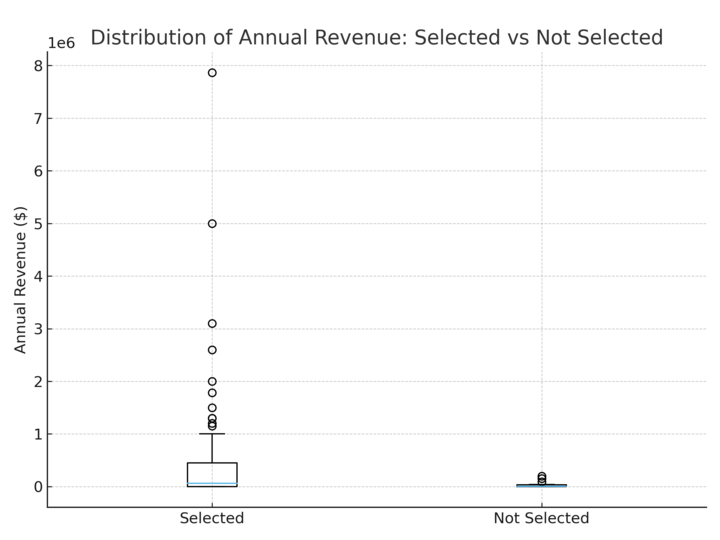

4. Traction matters

Median Revenue

All startups: $40K

Selected startups: $60K

Non-selected startups: $3K

This box plot helps show the full spread of annualized revenue between the selected and non-selected startups. The taller boxes and higher median line for selected startups reveal that they consistently had stronger traction (note:the dots represent the outliers with unusually high revenue compared to everyone else). Non-selected startups cluster near the bottom, showing far lower or no revenue. This visual makes it clear that revenue was a major signal for investor interest.

Takeaway #3: Revenue was a strong selection signal. As an early stage fintech or insurtech founder, you don’t need $1M in ARR but you do need strong indicators like early revenue, customers, paid pilots, LOIs and some initial market adoption.

5. Where are these companies being built?

We also found that fintech and insurtech innovation is more geographically distributed than ever:

Here are the top states in our pipeline:

New York

California

Georgia

Illinois

Wisconsin

Florida

Indiana

Takeaway #5: This strengthens a belief and value we hold closely at gener8tor:

Genius is in every community. We invest in the best and brightest across race, place and gender.

6. What does all this mean?

Here are a few ways to use this report:

If you’re a founder

You don’t have to fit perfectly into one vertical, but it helps if your work touches:

lending or credit

wealth management

insurance ops

claims & benefits

financial data

risk scoring

financial infrastructure

You also don’t need huge revenue, BUT you do need evidence that the market cares.

We’ve accepted companies whose fintech or insurtech angle wasn’t obvious until we took a deeper look.

If you’re an investor

Our deal flow aligns heavily with the exact categories that early-stage fintech investors are backing in 2025–2026. If your thesis touches financial infrastructure, financial planning, insurance automation or risk then we’d be happy to share relevant dealffow.

If you’re a corporate partner

These categories mirror the requests and priorities we hear from carriers, wealth managers, banks, and advisory groups. If your team has a priority area, we’re happy to help you find aligned startups or get you involved with our broader Corporate Innovation Network.

Whether you’re a startup, investor, or corporate partner, please reach out to me at mfoniso@gener8tor.com for more information.

7. Want to be part of the next wave?

So if you’re building in fintech or insurtech, here are a few of our industry specific programs that are or soon will be actively recruiting:

Deadline November 30th, 2025

Reach out to rowan@gener8tor.com for more information

Pinnacle Atlanta Innovation Accelerator powered by gener8tor

Upcoming Program: TBD

Reach out to keena.pierre@gener8tor.com for more information

Northwestern Mutual Accelerator

Upcoming Program: TBD

Reach out to precious@gener8tor.com for more information